Supercharging Your SaaS Business Model for Hypergrowth

February 20, 2020

Tyler Samani-Sprunk

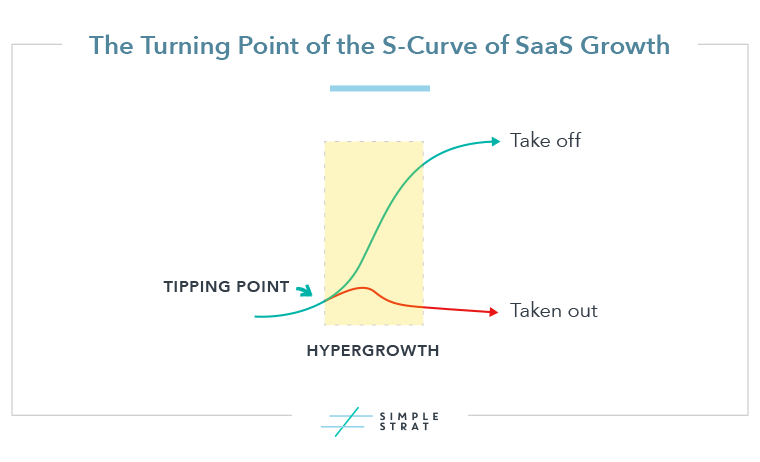

First described in Harvard Business Review in 2008, hypergrowth is “the steep part of the S-curve that most young markets and industries experience at some point, where the winners get sorted from the losers.” It’s at this point where SaaS marketers reach a key turning point in their business — either tune in and take off or be taken out by the competition.

For early-stage software as a service (SaaS) companies, hypergrowth success is dependent on the organization’s go-to-market (GTM) strategy and business model. This article will show you how balancing two very influential metrics can maximize your software company’s growth.

So, what is the secret to achieving and maintaining hypergrowth? And how can you supercharge your SaaS business model to support it?

The Role of LTV and CAC in Your SaaS Business Model

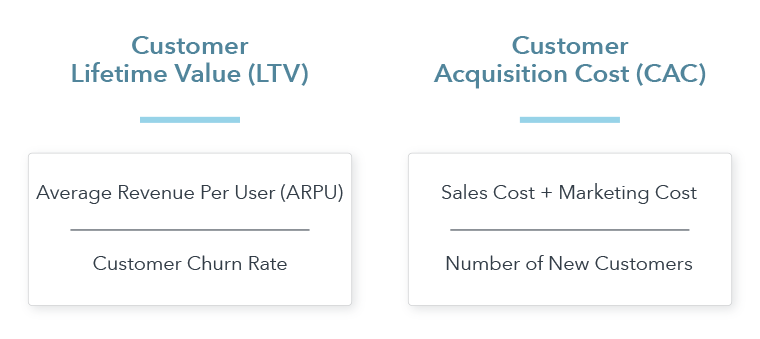

Lifetime value (LTV) and customer acquisition cost (CAC) — these two metrics alone can define the success of your SaaS business model. As the biggest influencers of unit economics, they’re the key numbers used to assess a business’s performance and growth potential.

In fact, LTV and CAC are used almost exclusively in forward-looking calculations for business growth. In the next couple of sections, we’ll look at how the ratio of LTV to CAC influences what you should spend to gain new customers and how it can help you figure out where to make that investment.

How to Interpret the LTV:CAC Ratio

Knowing your SaaS company’s LTV:CAC ratio can help you keep a pulse on your growth trajectory. The ratio describes the relationship between:

- How much you spend acquiring customers

- How you have positioned, packaged, and priced your product

- How long your customers purchase from you

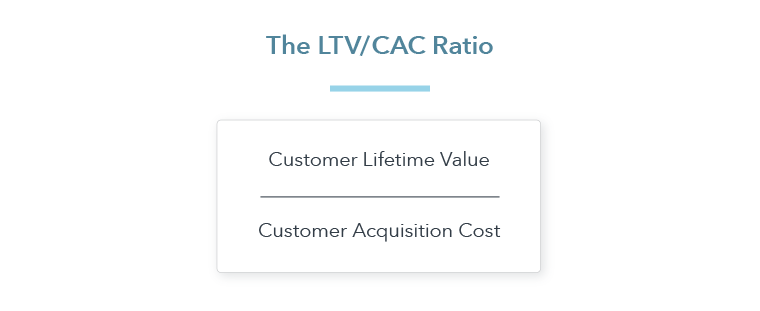

For SaaS companies, it is used to predict the profit or loss margin on each subscription purchase. It can also help marketers understand how long it will take to recoup their marketing and sales investment.

Understanding your LTV:CAC ratio will help you determine how well your company might perform in the marketplace. The better the ratio, the better your business model supports hypergrowth.

Sustainability Comes with a High LTV:CAC Ratio

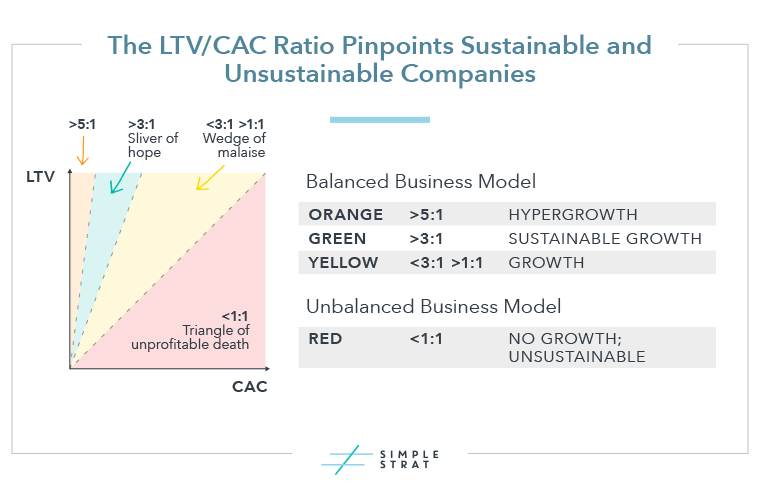

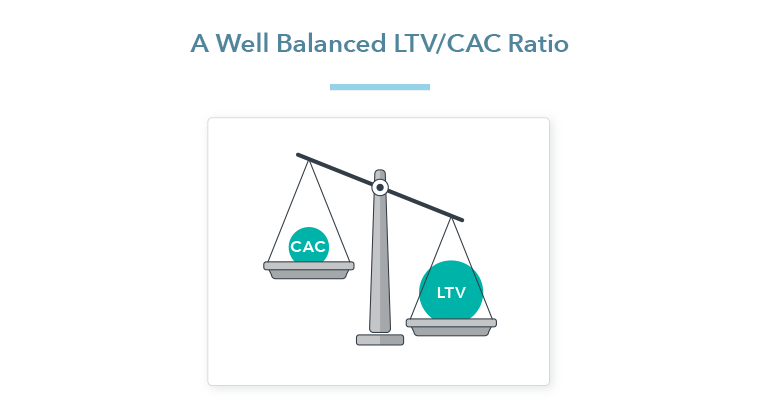

The typical LTV:CAC ratio of a sustainable company is around 3:1. Companies in hypergrowth, however, often have an even higher one — closer to 5:1, where its customers are worth about five times (or more) the cost of acquiring them.

Companies with a ratio where CAC is equal to or higher than LTV are unsustainable and can be met with a quick decline. While some companies maintain a small or even negative LTV:CAC in their early days to achieve rapid user growth, this can be a dangerous strategy if there’s no clear plan to increase LTV and/or decrease CAC in the future.

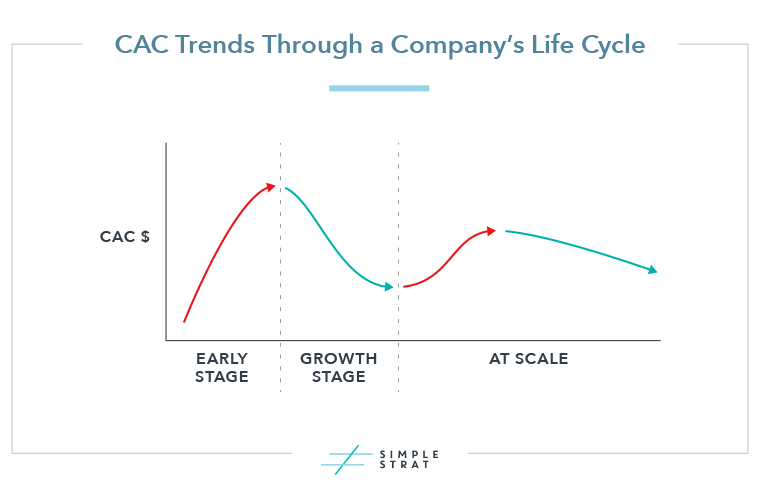

Maintaining an ideal LTV:CAC ratio can be a challenge. Your circumstances can change quickly as your business grows and matures, or as your market changes.

But why? Here are a few examples:

- The cost of experimenting with your product’s features and learning who your target market is at the early stage of your business can drive marketing and sales costs up.

- In the growth stage, your CACs might drop as you begin to finalize your product and maximize the promotional tactics that work for your business.

- When you reach scale — and as the market becomes more competitive — costs might begin to rise again as you work to differentiate against your competition.

Balance Your LTV:CAC Ratio to Support Hypergrowth

Identifying the efficiencies and the inefficiencies that drive your LTV:CAC ratio can help you better encourage hypergrowth. For example:

If you find out you’re being too cautious about your CAC, you can choose to invest more in your marketing and sales efforts. Or, if you learn you are spending too freely, you can adjust your pricing and simplify your sales approach before you end up in unsustainable territory.

Balancing your LTV:CAC ratio is a process of trial and discovery. With a little work, building a business model that keeps your company moving in the right direction and identifying the factors that will help you scale quickly is possible.

Before we look at the factors that drive a balanced ratio, let’s first look at what it means to have an out-of-balance and balanced LTV:CAC ratio.

If your customers’ acquisition costs are higher than their lifetime value, your business model is considered out of balance and unsustainable. If your costs are lower, your model is balanced and your business is considered sustainable.

There is no perfect ratio, but as we mentioned in the last section, the companies with the most profitable business models earn a lifetime value of at least three times what they spend to acquire a customer.

Learn What Drives Your LTV:CAC Ratio

As your business scales, you’ll want to make sure you keep a close eye on your LTV:CAC ratio. If you notice your ratio drops, take it as a warning sign that something in your business model is not going as planned. It could be that your pricing or packaging is wrong, or maybe the needs of your customer base have changed.

You can get the insights you need to scale your SaaS business by exploring your LTV:CAC ratio. Let's start by taking a deeper look at the impact of your pricing, expenses, and sales approach from the perspective of both metrics:

Factors that influence CAC

CACs are driven by the cost and effectiveness of your marketing and sales efforts. So, minimizing these costs by maximizing the effectiveness of your promotional tactics is ideal. The more you can increase your acquisitions, conversions, and referrals, the better.

How to decrease customer acquisition costs (CACs):

- Stronger customer knowledge

- Focused target market

- Less friction in sales process

- Customer referrals

- Thought leadership

- Inbound marketing

- Conversion rate optimization

- Partnerships

- Effective differentiation

- Brand awareness

How to increase customer acquisition costs (CACs):

- Weak customer knowledge

- Target market too broad

- Long and/or difficult sales process

- Heavy reliance on paid advertising

- Heavy reliance on outbound sales

- Strong competition

- Lack of optimization experiments

- Disparate marketing efforts

- Silos between marketing, sales, and service departments

.png)

Factors that influence LTV

LTV is a direct result of your customer’s loyalty and is driven both by the quality of your relationship with them and the accuracy of your monetization strategy.

Increasing your LTV by maintaining a relationship with your customers and continually iterating your product’s pricing and packaging strategy will help offset any necessary CACs.

How to increase customer lifetime value (LTV):

- Scalable pricing

- Proper packaging

- Cross-sells and upsells

- Good customer relationships

How to decrease customer lifetime value (LTV):

- Faulty pricing

- Improper packaging

- High churn rates

- Low customer satisfaction

.png)

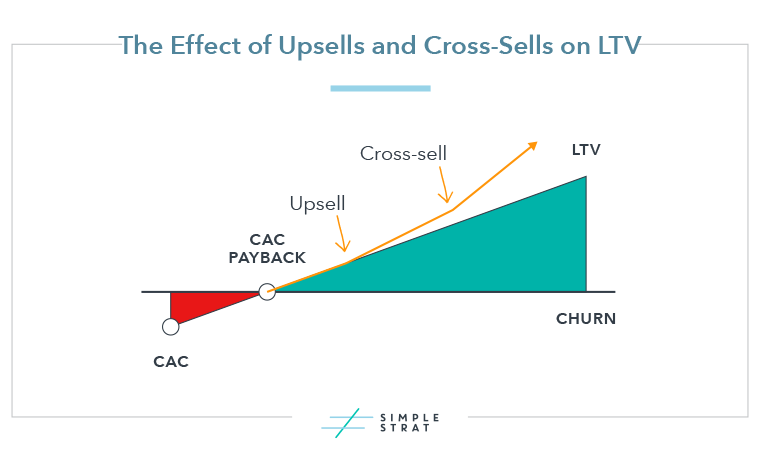

Visualizing the Most Impactful Adjustments to Your SaaS Business Model

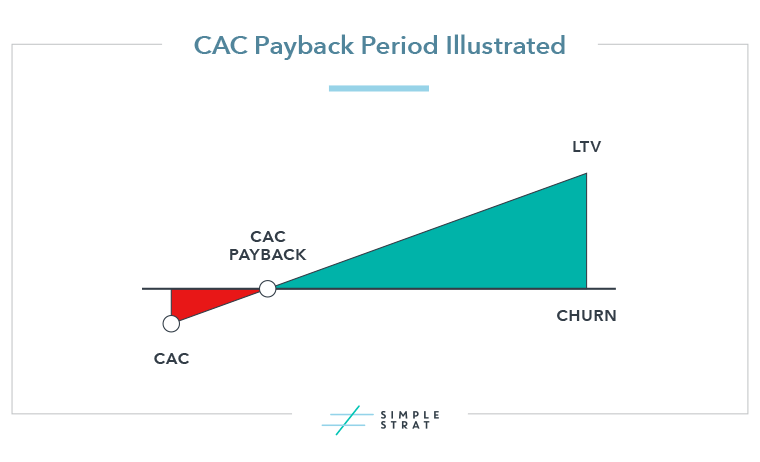

Recuperating your CACs is a major turning point in the early stages of your business’s growth. The sooner you reach CAC payback, the faster your company can scale.

The illustration in the first graph below shows common interactions of CAC and LTV — from customer acquisition to customer churn. This is the trajectory you hoped to accomplish when you first launched your SaaS product into the marketplace.

But, in all likelihood, things will not play out quite as you had intended. When that is the case or if you’re simply just looking to maximize your hypergrowth potential, here are two of the most impactful adjustments you can make:

Create a shorter payback period

You won’t benefit from a customer acquisition until their subscription revenue exceeds their cost of acquisition. Reaching CAC payback quicker will ensure you start making a profit as soon as possible, which will help increase LTV as long as your churn rate stays consistent.

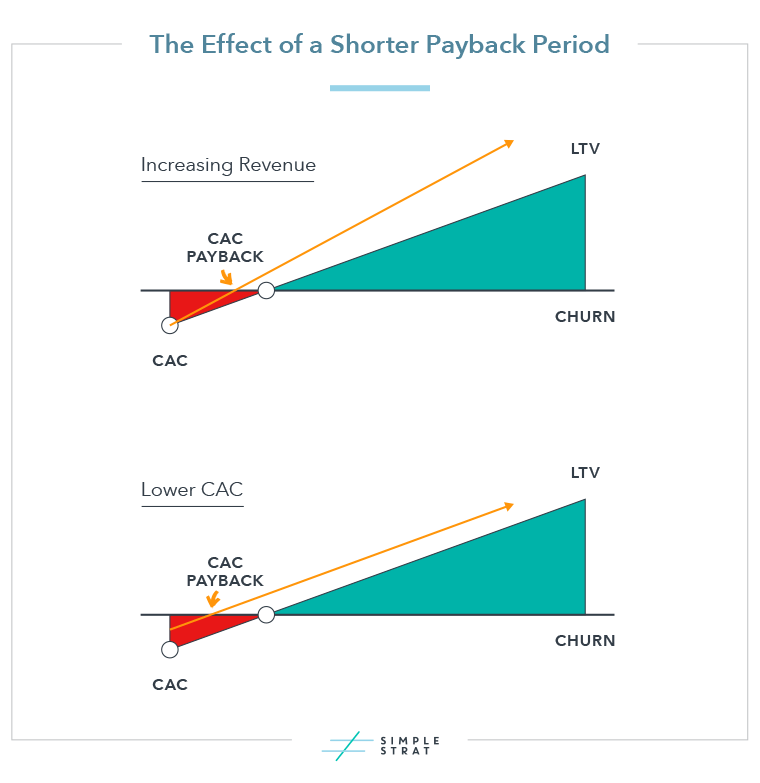

You can do this in one of two ways:

OPTION 1: Increase your revenue streams

Increasing your revenue will help you reach the breakeven point faster. Here are a few ideas for making that happen:

- Maximize your pricing and packaging strategies. Best practices recommend an iterative approach lead by a committee that meets at quarterly intervals.

- Prioritize building relationships with prospects. With the intention of turning leads into paying customers as soon (and as cost-effectively) as possible, many SaaS companies connect with leads within minutes of a qualified conversion such as a demo request.

- Focus on effective onboarding for your new users. Free trial customers who understand the full benefit your product can bring will be willing to begin paying for it sooner and paying customers will be more likely to see the advantages of additional uses or upgraded tiers.

OPTION 2: Lower your acquisition costs

Lowering your acquisition costs will lower your payback target and get you on the path to profits faster. Here are some ideas for cutting costs:

- Optimize your marketing tactics. Take a hard look at your most and least effective marketing channels and only put money into ones with proven returns.

- Amplify organic opportunities. Help traffic find you by exploring relevant keywords for additional SEO opportunities, taking guest speaking opportunities, and encouraging word-of-mouth marketing.

- Rethink your sales model. High-touch sales models come at a high cost. To save money, consider which aspects of your current workflow can be streamlined or reinvented with a low-touch approach.

Introduce more cross-sell and upsell opportunities

Another way to change the trajectory of your LTV:CAC ratio is to encourage your existing customers to spend more with you. Exploring upselling and cross-selling opportunities are great ways to continue to meet your customers’ needs and positively influence your bottom line.

So What’s the Secret to Preparing Your SaaS Model for Hypergrowth?

Scaling your SaaS company is more than keeping your CAC low and your LTV high. It’s also building lasting relationships with your prospects and your customers to reduce churn.

If you’re approaching hypergrowth, which metric are you focusing on? How are you ensuring your SaaS business model is a successful one and supercharged for growth? Have we missed any important considerations?

Tyler Samani-Sprunk

Tyler Samani-Sprunk is a co-founder of Simple Strat and leads the HubSpot Services team. As a top contributor to Martech.org and co-host of HubSpot Hacks, Tyler has an innate talent for solving complex problems and driving results with HubSpots. Subscribe to his admin-focused LinkedIn newsletter, The Orange Admin, for in-depth platform tips.

Relevant Blog Posts

Top 26 HubSpot Hacks for Marketing Pros

If you've invested in HubSpot Marketing Hub, you know the promise: powerful growth, streamlined processes, a happy team. But let's be real – there's a TON of info out there on HubSpot. Sorting...

Marketing Collateral: The Ultimate Guide (With Examples)

When we’re talking about marketing, things can get kind of buzz-wordy. Marketing collateral. Landing pages. Audience personas. Ever feel like you need a guide to walk you through these things?...

Using Content for Top-of-Funnel Marketing (Plus Examples)

What does your content have to say? Does it answer your audience’s most burning questions? Does it bring them value after they read, watch, or listen to it? Delivering value via content is especially...